Interested?

Email: Your name and phone number: info@valucorp.com

Note: There are no up-front fees or obligation to inquire.

Introduction to a Exit Plan Strategic

- When do you want to exit?

- What method or methods will be used to assess the value of your business, and how confident are you in that process? https://valucorp.com/methodology/

- Do you agree with the value determined by a professional? https://valucorp.com/business-valuations/

- How much of your financial freedom is based on the sale of your business? Is there a value gap? https://valucorp.com/valugap/

- How do you see your involvement in your business changing or evolving in the future?

- What obstacles are you seeing that could derail your business or personal goals in the coming years?

- Which exit strategies do you consider and which are out of the questions?

- Pass to Family

- Sell to Outside Third Parties

- Sell to Inside Key Employees or ESOP https://valucorp.com/esop-employee-stock-ownership-plan/

- Planned Liquidation

- IPO or SPAC https://valucorp.com/iporeadiness/

- Franchising or licensing https://valucorp.com/franchising-obtaining-financing-and-rapid-market-penetration/

- What is your plan for your ownership interest? Do you plan to pass ownership along, or arrange for a sale some day?

- Given your (buyer or successor) plans, have you thought about who the best leader for your business might be when you retire?

- What will happen with your customers, vendors, employees, and competitors if something happens to you before you execute an exit plan?

- What value drivers can you implement now while planning an exit? https://valucorp.com/valuscore/

- What do you see as your greatest challenge when you think about planning for the future?

- Have you thought about how to transition from daily duties to advisory role?

- Can you test the waters for your company’s value?

- Have you considered a tax deferred transaction? https://valucorp.com/tax-planning/

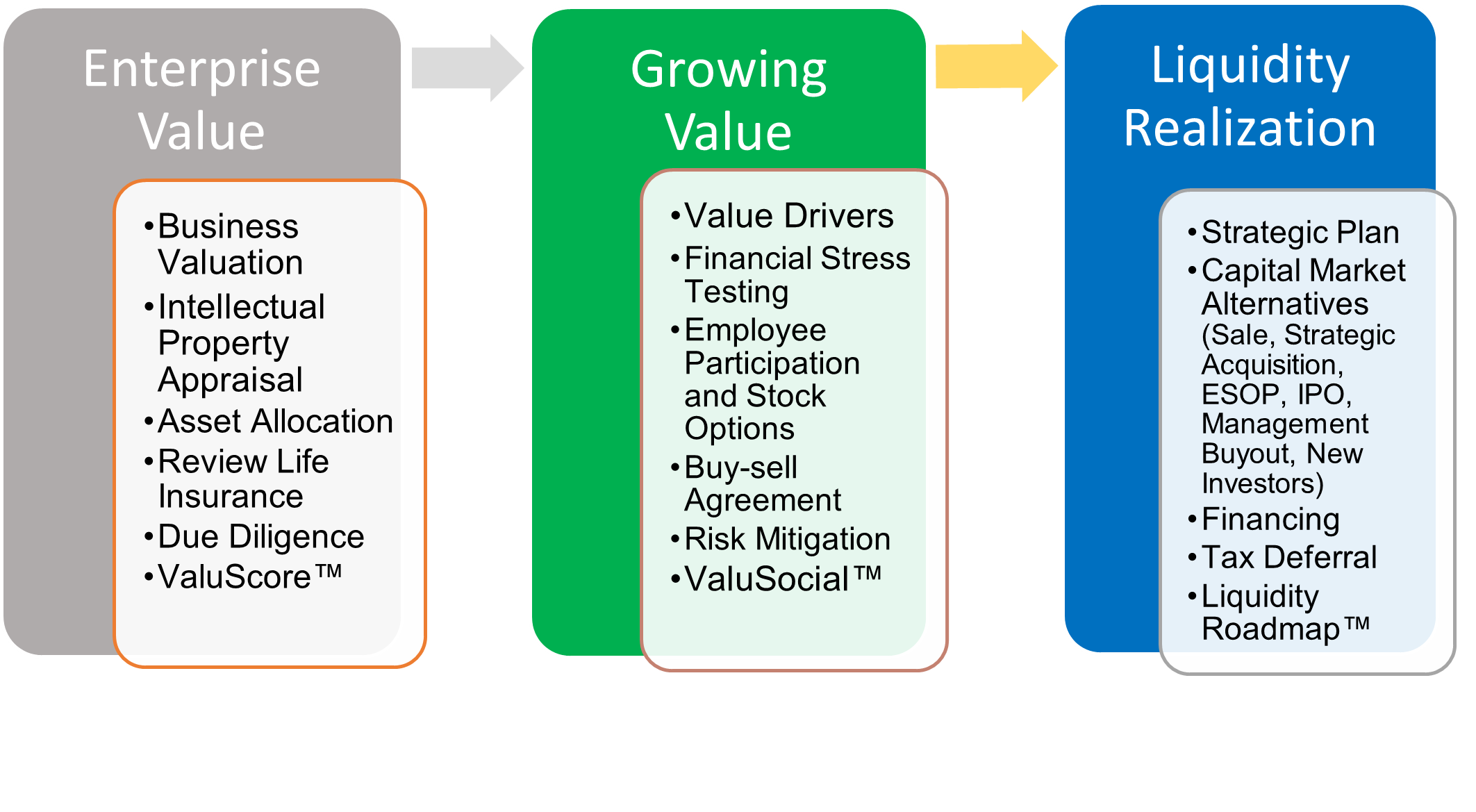

Our Liquidity Roadmap™ shows you the best Exit Plan for your business:

Unique Attributes of our ValuPlan™

- Business Development Officers nationwide

- Business Valuation preparers have highest credentials – ASA, JD, CPA, MD, PhD, MBA, MST, MHSA

- Rapid report delivery

- Most appropriate fee structures

- Unmatched marketing – grow your business while exiting to maximizes proceeds

- Experienced professionals – from entrepreneurial to leadership at Fortune 500 companies

- Liquidity Options – broadest array of done deals

ValuCorp Exit ValuPlan™ Strategy

- 1. Business Valuation, Intangible Appraisals and Fairness Opinions

- Determine a company’s value by credentialed experts, with credible assumptions and financial projections to provide assurance that the determination of Fair Market Value is fair to prospective buyers and investors from a financial point of view.

- Optimize value by identifying, allocating and appraising your company’s many Intangible Assets, Patents, Brands, Copyrights, Customer base, and other Intellectual Property Assets.

- Mitigate risk factors (every business has them) with adding value solutions.

- 2. Due diligence and ValuScore™

- For the Business Owner:

- A ValuScore™ helps the Business Owner understand the Capital Markets Alternatives. Capital markets options provide alternatives for, pricing, timing, and probability of success.

- For the Investor, Buyer and Lender

- The ValuScore™ provides validation of the premise that the promoter is sponsoring and seeking investors

- This Deal Screening Process scores and rates your business as a financing candidate:

- – Deal rating and score computation to assess the funding potential and its cost to your business, as documented in a Business Valuation.

- – Preliminary due diligence to ensure that many of the corporate documents are in order.

- – Deal presentation material additional information to support the presentation to funding sources.

- For the Business Owner:

- 3. Source Capital to Make Improvements

- A Reg D 506(c) Private Placement will source prospective Accredited Investors to your website.

- Implement a Reg D program to provide viable companies, including start-ups, that are seeking to build Brand Awareness and/or attract Accredited Investors.

- Use Social Media with your Business Valuation to achieve brand awareness and obtain financing to maintain and improve continuity during this process.

- 4. Income Tax Deferral for 40 to 80 years

- Similar to that used by Facebook’s Mark Zuckerberg in December 2015, you can defer taxes when you sell your business or have an exceptionally good income year.

- The Structure leaves you (and your family) in complete control of the assets for multiple generations.

- The Structure affords you the opportunity to provide income payments to any number of charities while creating a large philanthropic endowment—all without divesting the family of the economic value.

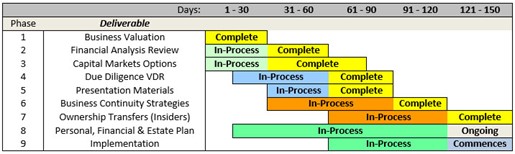

A typical Liquidity Roadmap and Timeline: