► Liquidity Roadmap™ – a plan for Business Owners designed to identify and achieve their financial, personal and estate planning goals by maximizing the opportunities to obtain liquidity for the business or the Business Owner.

The Liquidity Roadmap™:

Requires the participation of experts in the areas of business valuation, business and estate law, accounting, business consulting, business brokerage, investment banking, and financial planning.

- Documents formal recommendations resulting from the team’s 9-phase analysis of the business, its industry and the economy in which it conducts business.

- Benchmarks progress and milestones for executing recommended action plans.

A team approach allows the Business Owner to capitalize on the specific areas of expertise of each advisor in developing the Roadmap. The result is a comprehensive and coordinated plan. The Liquidity Roadmap™ helps maximize financial return, minimize tax liability, plan for contingencies and increase the likelihood of a successful liquidity event by utilizing a collaborative approach. Most importantly, you will obtain clarity, certainty and peace-of-mind.

ValuCorp assists owners and their advisors in rounding out the team of disciplines to successfully complete the plan. You should coordinate the process and craft the Liquidity Roadmap™, based on the analysis and recommendations from all the professionals on the collaborative team.

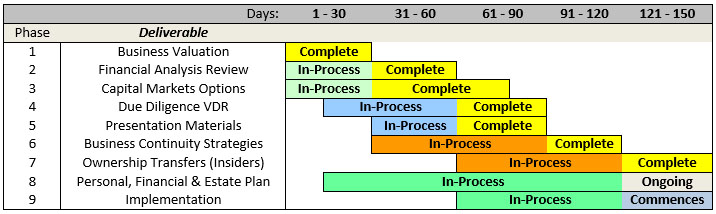

A typical Liquidity Roadmap and Timeline:

- Phase 1: Business Valuation – Expert Determination of Fair Market Value by Accredited Senior Appraiser (American Society of Appraisers). Since most businesses are their owners’ largest and most valuable assets, a market-smart, current market value is the essential starting point in determining when and how the owner’s financial objectives can be met. Valuation methodologies analyze the business, its industry and transactional trends, the effect of the economy and the interrelationship between assets, liabilities, income, expenses and market conditions.

- Phase 2: Financial Analysis Review – Determines financial strengths, weaknesses and growth potentials. Report includes Financial Projections to improve and maximize the business’ value, and document sustainability of earnings. The company’s performance and results will be compared to others in its industry while identifying value drivers to meet overall liquidity objectives.

- Phase 3: Capital Markets Options – Evaluates suitability of various types of liquidity events through a multi-layered grading system, providing the Business Owner with valuable information to determine objectives.

- Phase 4: Due Diligence VDR – A virtual data room (VDR) on a dedicated Web site will provide authorized users access to a secure, on-line repository of a company’s documents. Documents are stored in an easy-to-read electronic format on a central server that’s accessed securely via the Internet, eliminating the need for bidding parties to travel to the documents that validate company books, records, legal contracts and business information to show a company’s unique attributes and value proposition.

- Phase 5: Presentation Materials – Confidential Business Review or Lawyer-Ready Private Placement Memorandum, to market and present to buyers, lenders, investors, investment bankers, M&A specialists, and other financing sources to determine their level of interest in a Transaction (sale, loan or investment), focusing on the benefits of the proposed transaction. Includes the key door-opener, the Summary Pitch book, to ascertain initial interest in a transaction, focusing on the benefits of the proposed transaction.

- Phase 6: Business Continuity Strategies – Prepares the Business Owner for the contingencies that will affect the business and its stakeholders during the process by assessing the current and future need for a transition plan, and assessing disaster and risk management, plus leadership and business succession.

- Phase 7: Ownership Transfers – Prior to or concurrent with the proposed transaction, outline advantages and disadvantages of transferring ownership interests to family members, co-owners, key employees, charities and/or third parties.

- Phase 8: Personal, Financial & Estate Plan – An objective-based plan for achieving long-term financial goals by integrating the business liquidity event with other assets. Analyzing combined business and personal financial resources to recommend a course to achieve ultimate goals.

- Phase 9: Implementation – The final phase of the Liquidity Roadmap™ is to review its analysis and recommendations with the Business Owner and other stakeholders, and provide assistance with the implementation of recommendations by transitioning to the Deal Team. Use your professional team for on-going consulting on a regularly scheduled basis or to help you with Strategic Planning for Value Growth™.